Digital currency

Bitcoin is the most famous example of what is now called digital currency or cryptocurrency. Unlike traditional money, bitcoins are not managed through centralized financial institutions. A single bitcoin is worth about 6,600 USD, and you can own a unit as small as a single hundred millionth of any bitcoin.

The site coinmarketcap.com lists over 1,200 digital currencies, with Bitcoin having the most prominent market cap. Bitcoins were introduced in 2008 with millions of transactions happening since then.

Blockchain

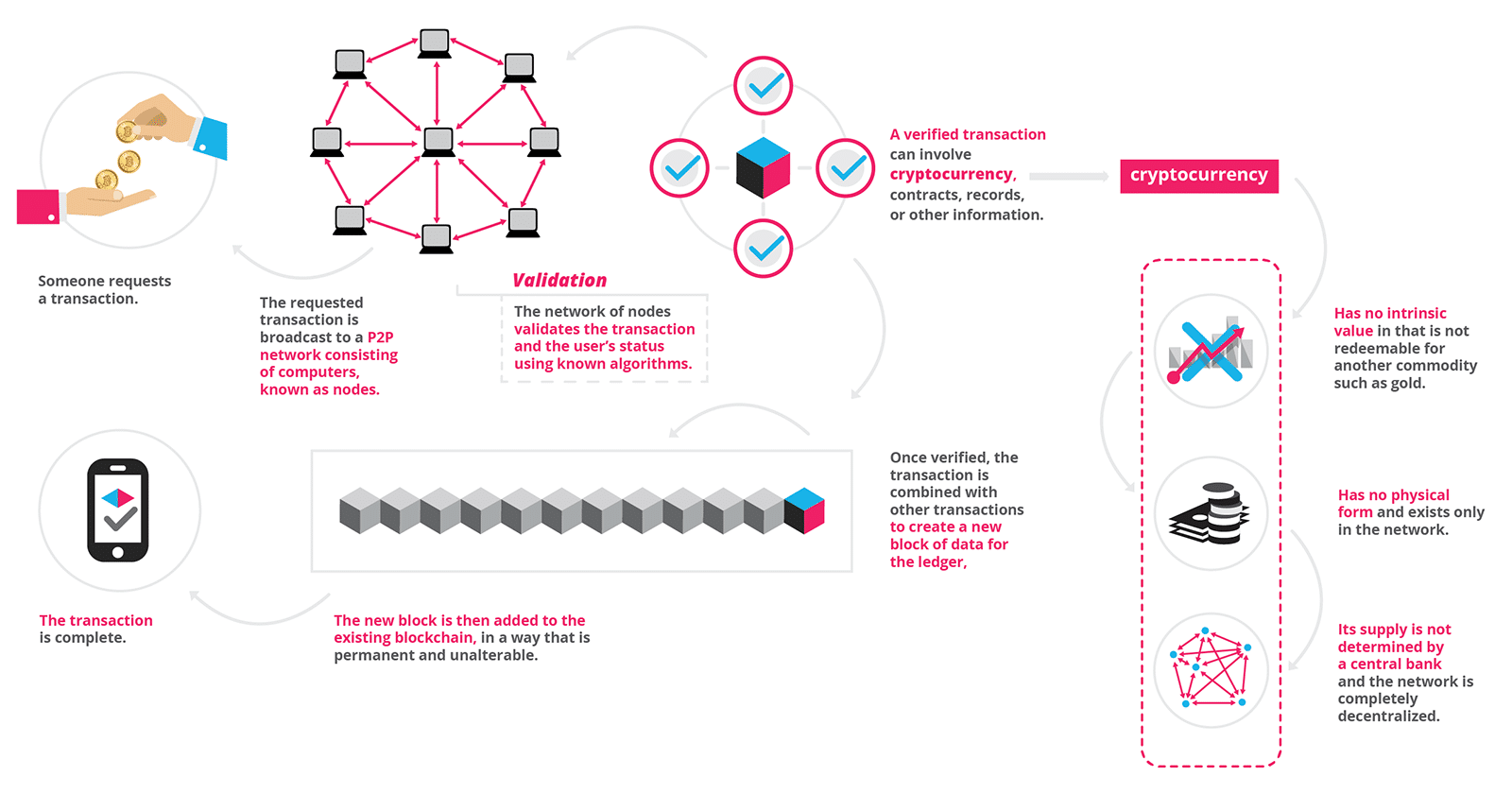

The underlying technology of Bitcoin is blockchain. The basic construct behind a blockchain is a network, where nodes correspond to computers connected over the internet. Each node stores past transactions and validates new ones, typically using some kind of proof-of-work system such as a cryptosystem. Each new transaction is a block, and blocks are added to a shared history in the chain. Blocks are shared with all nodes as a kind of public ledger. No one computer controls all the blocks, but all of them validate new blocks.

We can think of blockchain as a kind of giant, shared spreadsheet on Google docs. However, you can’t make any changes you like to the spreadsheet, as the changes have to conform to the rules of the system.

Applications of blockchain

Bitcoin and other digital currencies like Ethereum use blockchain technology, but there are other uses of a very different nature. MIT’s registrar recently announced they will use blockchain technology to manage their student record system. Their records system will allow students to share their diplomas in a way so they can be easily verified by an employer. These registrarial transactions will be free and paperless. Not too shabby, MIT!

Other current and potential uses of blockchain include online voting, smart contracts, and medical records. Some say blockchain technology will revolutionize banking, much like the internet revolutionized media.

One of the interesting aspects of blockchains is their inherent security and lack of centrality. Hacking them would require a computationally costly recalculation of all the previous blocks on a sizable number of nodes in the network. There’s a kind of herd immunity there that prevents widespread tampering.

It’s early days still with these technologies. However, even if you don’t put faith in bitcoin, blockchains look like they are here to stay.

Enter complex networks

I’ll finish with a brief segue on research related to the underlying network structure of the bitcoin network. Bitcoins, represented as addresses, form nodes, and edges correspond to transactions between them. This makes the bitcoin interaction network into a graph, which is something we can quantify and study.

Researchers present structural properties of the bitcoin interaction network in the following papers:

D. Kondor, M. Pósfai, I. Csabai, G. Vattay, Do the Rich Get Richer? An Empirical Analysis of the Bitcoin Transaction Network, PLoS ONE 9(2): e86197, 2014.

D. Di Francesco Maesa, A. Marino, L. Ricci, Data-driven analysis of Bitcoin properties: exploiting the users graph, Int J Data Sci Anal, 2017.

Their findings confirm that the bitcoin network is another example of a complex network, which are large and evolve over time. Examples of complex networks range from the web graph, social networks, and protein interaction networks.

Two key features of complex networks are the small world property and power law degree distributions. For the small world property, the network should have short paths connecting randomly selected nodes. We also see high local clustering, so pairs of nodes with a common neighbor are more likely adjacent.

Power law degree distributions point to the networks having an undemocratic character: most nodes have the low degree, but some have high degree. In other words, there is a small group of nodes which have most of the links.

These properties and others were uncovered for bitcoin networks and networks of bitcoin users. An interesting mathematical question is whether bitcoin networks are best fit by established network models like preferential attachement, or by other, as yet undiscovered models.

Anthony Bonato